Features of the Ninja trader platform – Order Book and T&S List

Features of the Ninja trader platform – Order Book and T&S List

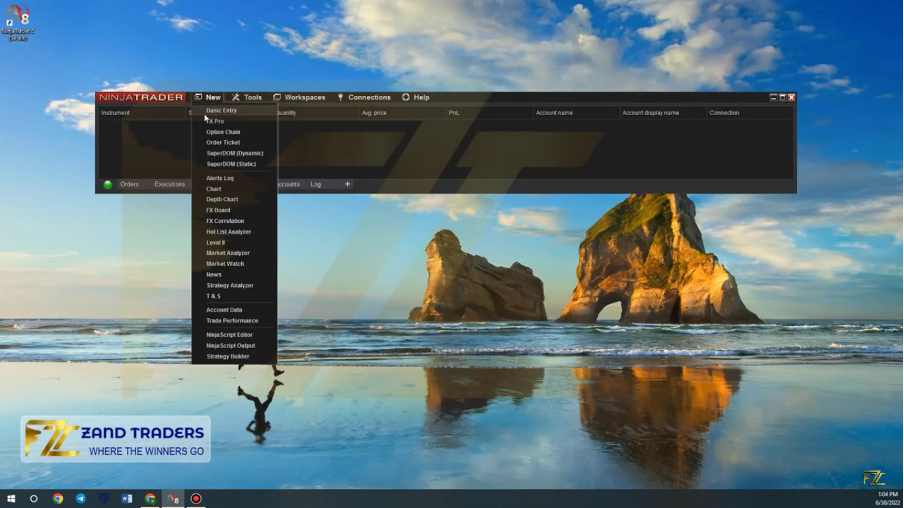

In this article, we discuss the rest of Ninja Trader’s features. First, open your Ninja Trader platform and connect to level 2 of data. Now click on the New tab.

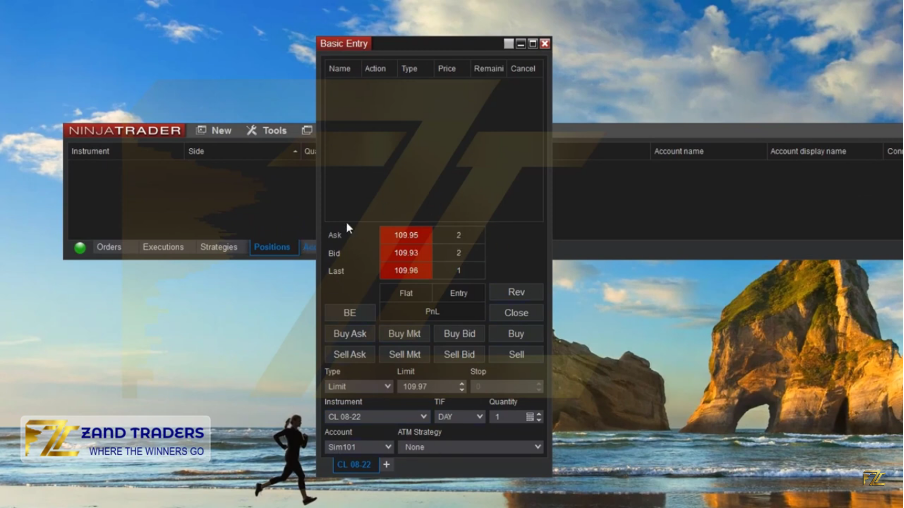

The first option is Basic Entry, as its name suggests, this option allows us to use chart trader panel features without accessing the chart. Using this possibility is not recommended due to the lack of mastery of charts and live volume data of the market.

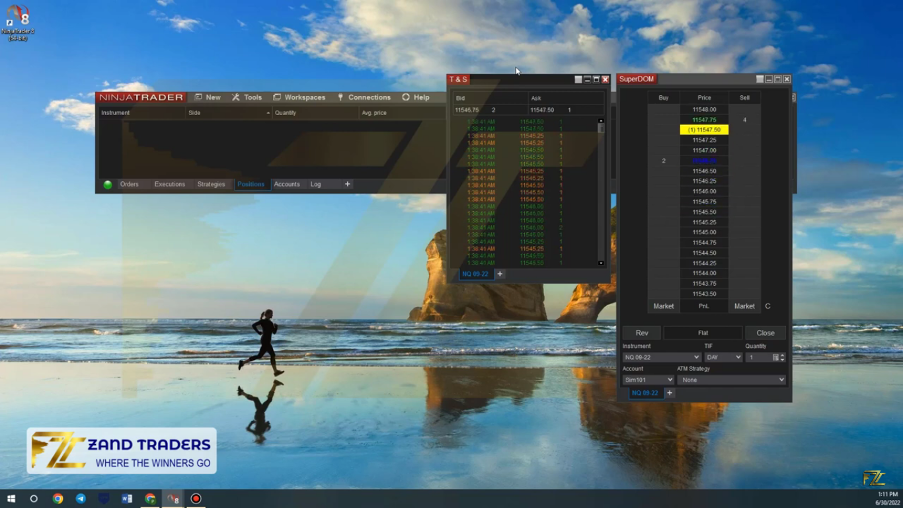

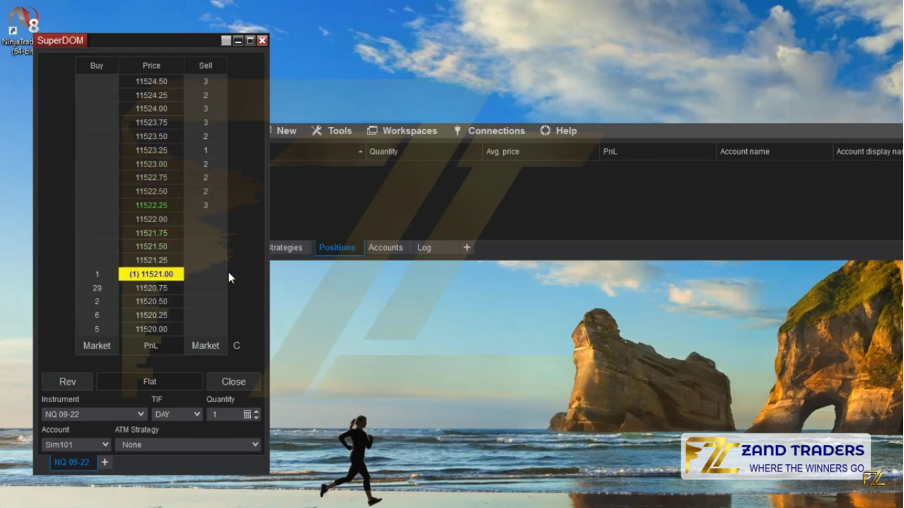

The next important option is Super DOM or Depth Of Market. In the volume trading method, we use this possibility and it is very important to see the depth of the market. Using this possibility, you can know passive buyers and sellers.

On the right side or Ask you can see the sellers in the queue and on the left side or Bid you can see and check the buyers in the queue. Due to the importance of knowing DoM in volume trading, we will specifically examine and teach this possibility in Ninja Trader.

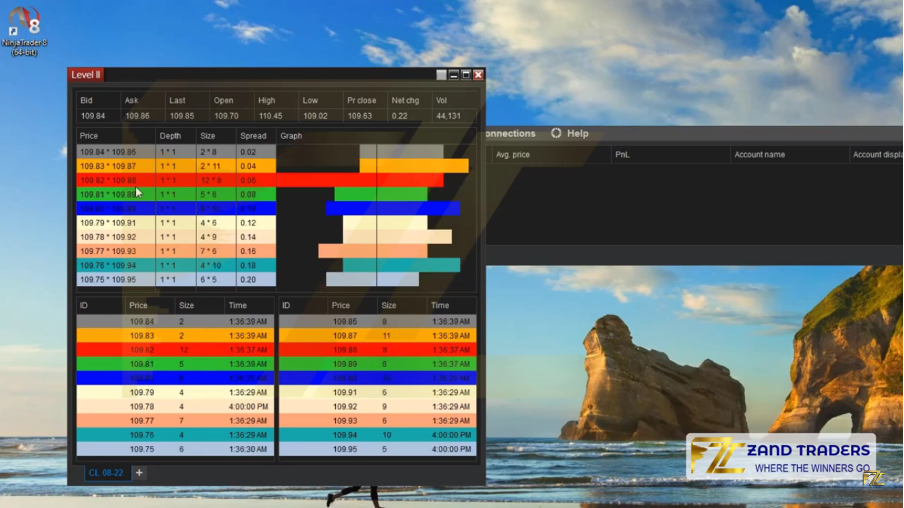

The next option is Level II, which gives us an overview of the chosen instrument, the price, volume of orders, etc., among other information that we do not use in the volume trading method.

The next option Market Watch gives us an overview of the volatility of the selected instrument. In fact, you get a view of the fluctuations of your desired instruments.

Strategy Analyzer and Strategy Builder are two options for people who are fluent in programming language. Using the programming language, you can create a strategy or robot for your Ninja Trader and use it, but we do not need to use this possibility in the volume trading method.

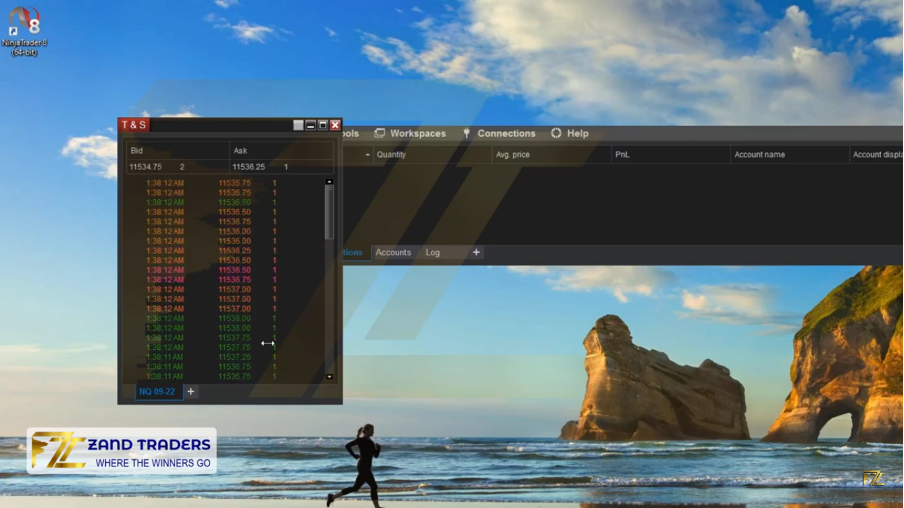

The next very important thing that is very important in volume trading and we will cover it completely is T&S. T&S stands for Time and Sale List, which means the list of transactions made along with the time of transaction. T&S is next to Order Book or DOM. Here we will have aggressive buyers and sellers. In fact, the transactions that have been done are recorded in this list. It is the purchases and sales that make the market. Aggressive buyers buy from passive sell orders placed in the DOM and aggressive sellers sell to passive buy orders placed in the order book.

DOM and T&S are the basis of order flow or volume trading and are among the oldest trading tools. But it is very difficult to use them that with our software developments, we can receive and check the information of these two in a clearer and easier way.

In the following, you will be provided with advanced software that will make the work of review and analysis easy and convenient for you, and in addition, you will also have the option of filtering data as you wish.