Stop-loss limit in forex trading and everything you need to know about it.

Stop-loss limit in forex trading and everything you need to know about it.

Due to the fact that in forex, the movement of the market cannot be accurately predicted and is associated with a lot of risk, you need a trading strategy to succeed in market. The stop-loss limit in forex trading is one of the trading strategies that can prevent heavy losses that the trader may suffer. Follow Zand Traders in this article, we will introduce you the stop loss in forex trading.

What is the limit of stop-loss in Forex trading?

In general, in forex trading, all investors try to stop losses as much as possible. Stop loss is a good stop loss tool, especially for novice traders.

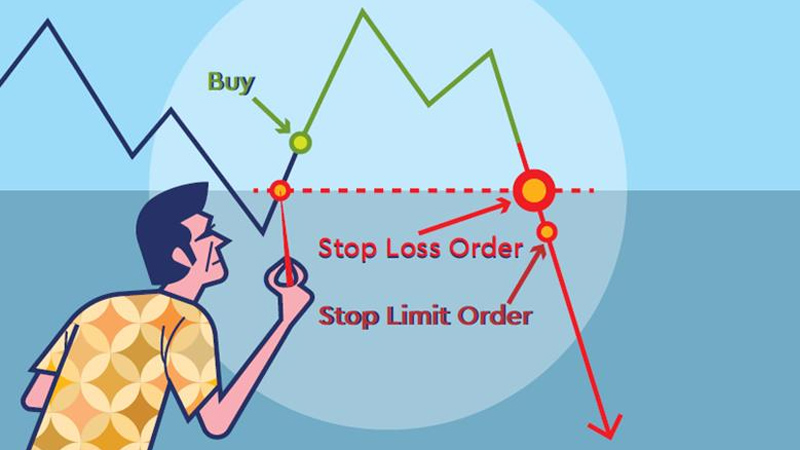

A stop-loss order in forex trading is a tool that is used in forex trading and is designed to limit the losses caused by a trade.

A stop-loss order in forex trading triggers the transaction to be closed at a loss and is issued by the trader to trading companies or brokers to execute a transaction when the market price is at a certain level. It has a price lower than the price of entering the business.

No Forex trader wants to lose, but since losing some trades is inevitable, it is better to reduce the losses as much as possible and reduce the exposure to risk.

Why Stop-loss limit is important in Forex trading?

If we can answer the question, what does the loss limit indicate in forex? then we can understand the importance of this tool in trading.

To answer this question, read the following explanations carefully.

In order to reduce the trader’s loss in a particular position or situation, the broker uses the loss limit order. This order can be used in long-term situations for buying and short-term in selling.

When the stop-loss limit order is used in forex trading, the influence of the trader’s emotions on the trading by the broker is removed.

In the forex market, transactions cannot be accurately predicted, and for this reason, the prices in the future of the market are not known, and in order to reduce the risk and loss in transactions, the stop-loss limit is used in forex transactions.

An example of a stop loss order in forex

In this part of the article, we have given an example of the loss limit order. To better understand the meaning of this term in Forex, read this example carefully.

An example of loss limit in long-term trading

If the market order to buy 5 lots of EUR/USD is at the price of 1.1750, and the loss limit order to sell 5 lots of EUR/USD is set at 1.1730, then the trader’s loss in case of a decrease in the price of EUR/USD is as much as $5 will be multiplied by 20 pips.

Now that you are somewhat familiar with stop-loss order and understand its meaning, we will introduce you several types of stop-loss order strategies in forex.

Introducing stop-loss strategies in forex

You can use these few strategies in order to benefit from the loss limit order in forex.

Fixed loss limit

In the fixed loss limit order, traders can set a specific price for the limit loss and not touch it until the end of the trade. Choosing a fixed loss limit is almost easy and you can specify a loss limit where the profit to loss ratio is 1:1.

Fixed loss limit based on indicators or indexes

In this method, traders can determine the limit of loss from real market information using indicators. For example, they determine the distance of the loss limit from the point of entry into the transaction based on the ATR index.

Manual moving loss limit

If the trader wants to have more control over his transactions despite setting the loss limit, he can specify the stop-loss limit according to the progress of the market. For example, when the market is in a downward trend, the trader places the loss limit in lower positions, and when the market finds an bullish trend, the loss limit is activated in the upward direction and the transaction ends. .

Moving loss limit

In fact, the moving loss limit makes it possible for traders to create moving loss limits as the market progresses, and in this way they can manage their money better. In this way, they can reduce the amount of risk to a great extent by shifting the loss limit in transactions and lose less.

Moving loss limit with fixed steps

The limit of moving losses has the ability to be ordered in such a way that they move by a certain amount every time. For example, the trader can set the limit of moving losses in such a way that in the direction of market movement, they should also be moved by 5 pips.

Is the loss limit in forex trading reliable?

There are many people who have this question: is it necessary to activate the stop-loss limit in forex trading? And does this tool work properly and is it reliable? And when is the exit time?

In response to this question, there are two different theories:

Some traders believe that it is necessary to use a stop-loss limit order in transactions so that whenever the market does not move in the direction of your transaction, you can stop the loss and terminate the transaction by specifying the loss limit and get out of it.

Other traders believe that in order to avoid losses in trades, it is necessary to exit the trade before reaching the loss limit in order to incur less loss. These traders believe that the loss limit should be determined as a precaution and before that, the transaction should be ended.

As a result, it is not clear which group of traders is correct, and both opinions have advantages and disadvantages. So it depends on the trader herself and her trading style, and there is no specific criterion for using stop-loss orders in forex trading.

Final word

The stop-loss order is effective in the forex market to prevent the trader’s losses in the market. But if you use this tool only as a protection for your account, it is necessary to constantly monitor the market so that you can exit the market yourself before it becomes active.

But if you have a job other than trading in the forex market and your transactions are open during the day and night, the loss limit will work for you and the transaction will be terminated in the specified places.

In any case, it doesn’t matter which type of stop-loss limit you are considering, in any case, it is recommended that you definitely use the stop-loss limit in your transactions; because your transactions and your account will be more secure.