What is a flow order? Flow of orders in Forex

What is a flow order? Flow of orders in Forex

In this article, Zand Traders intends to introduce you another trading strategy called Order Flow. You may know some of what overflow is, but you do not know how it is used in trading. So stay tuned to Zand Traders until the end of this article to learn more about overflow, and to know how to use overflow in trading!

What is an Order Flow?

A general definition that can be given to overflow is that, overflow is the volume of orders that are waiting to be executed at price levels and more importantly, the volume of orders that are executed.

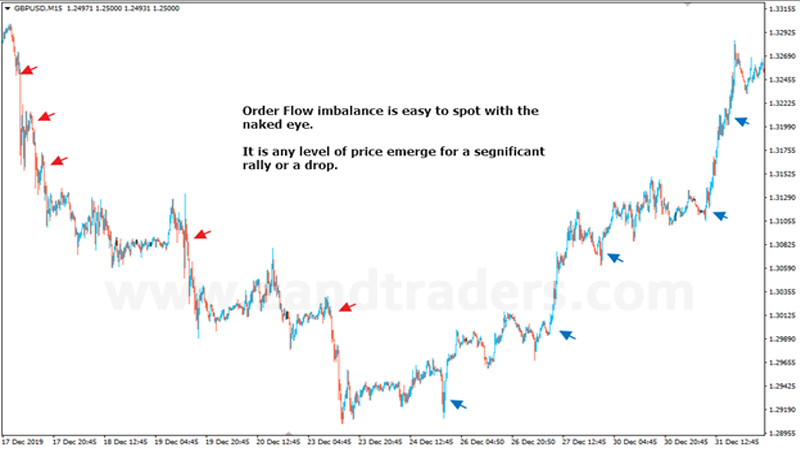

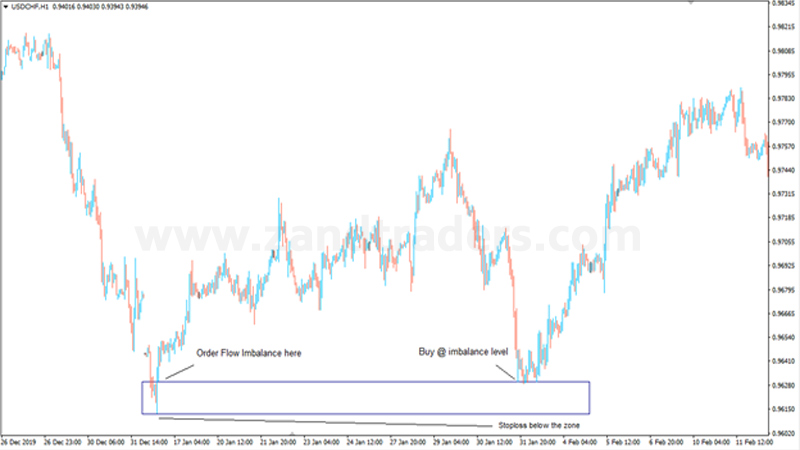

Order flow analysis is a unique concept related to transaction analysis and can help you trade more confidently and by observing the imbalance of orders at the expected price level, in the direction in which the flow orders are stronger enter the deal. Therefore, the flow of orders can provide you with the conditions to enter the market more accurately and confidently.

Order flow analysis is actually just a very simple way to read charts. In other words, for easier understanding, it is also called supply and demand analysis. What has been said is what overflow is, and its main concept is simply to read charts to understand the story of buyer and seller decisions.

The flow of orders basically depends on whether there has been a significant decision to significantly reduce or increase the price in the recent past of the market, Notice that this indicates, wherever a strong price movement has occurred.

What is the most important advantage of overflow in trading?

Overflow analysis provides the conditions for you to look at the trading process and wait for certain levels to enter the market, and this is a great advantage and the conditions of buying at a very cheap price and selling at the highest and most expensive prices.

Now that you know what overflow is and what benefits it can bring to traders, it’s good to know how to use overflow trading.

Order Flow trading strategy

Order flow strategy teaches you how to get the mindset of a professional trader. Trading using order flow (overflow trading) can help you get more valuable information about what goes on behind the candlestick price chart.

When there is an imbalance in supply and demand, the price moves; And as a trader, it is up to you to identify this imbalance; and you can recognize this imbalance by learning overflow trading.

Familiarity with flow trading

Order Flow Trading is a type of chart analysis that involves examining the flow of trading orders and their subsequent impact on price to predict future price movements. In other words, order flow analysis lets you see how other market participants are trading (buying or selling).

And as we said, this is one of the most important benefits of using overflow trading.

Using Order Flow helps you identify the final details of sales volume and have a microscopic look at candle stick studies; This is because there is a lot of information inside each candlestick that can be analyzed through the flow of orders.

An overflow chart shows you exactly how many orders have been placed in the market at each price level.

Basically, you can view order flow trading as a volume-based trading system.

Trade training using order flow or overflow

The trade training course using the flow of orders includes various chapters that you will fully learn by participating in these courses; but in this part of the article we will mention how to trade using the flow of orders.

How to use the flow of orders in the trade

In general, in technical analysis, we look for areas or price levels where we can trade; and in order flow analysis, we look for clues as to when and at what price to trade.

Overflow analysis can give the trader information about the following:

– Large buy orders (orders that can make a fundamental difference in the market price).

-Accelerate sales

-Liquidity flow (what is the volume of sales orders: small, medium or large).

-Momentum burnout

-Buyers trapped and sellers trapped

-Stop Hunting

This is important information that you will obtain through Order Flow analysis.

Where to start for proper order flow analysis?

To analyze the flow of orders, first of all, you need real stock market data; you can access a feed provider for this purpose. Like CQG or Rithmic

Secondly, you need overflow software. By searching the net, you can find various software providers, including Ninja Trader or ATAS.

Next you need to connect the order flow software to data feed, which is a simple process;

In short, the steps of trading through overflow trading are:

-Provide trading software

-Preparation of data feed and broker

-Connect software and data feed

-Start futures trading

The final word

Now you know what order flow is, and what trading means by analyzing the flow of orders and how it is done. There are many tools for Forex trading with Flow Orders. The most well-known tools are: footprint chart, volume profile and order book. This way you can see exactly the trading volume in the charts.