Differences between forex and futures market and introduction of level 1, 2 and 3 of data

Watch high quality video on YouTube

Differences between forex and futures market and introduction of level one, two and three of data

As stated in the previous articles and training videos, we do not have data in forex because this market is a decentralized market and copied from the American futures market, and when it comes to volume, order book and T&S, we must pay attention to the fact that to use these tools, we need data, so we have to use the American futures market to access the data.

In the article the differences between forex and futures market, we are going to talk about the difference between forex (CFD), futures, as well as the difference between level 1, level 2 and level 3 of data.

The first step of the differences between Forex and futures market:

Let’s check whether the displayed volumes in Meta Trader are reliable?

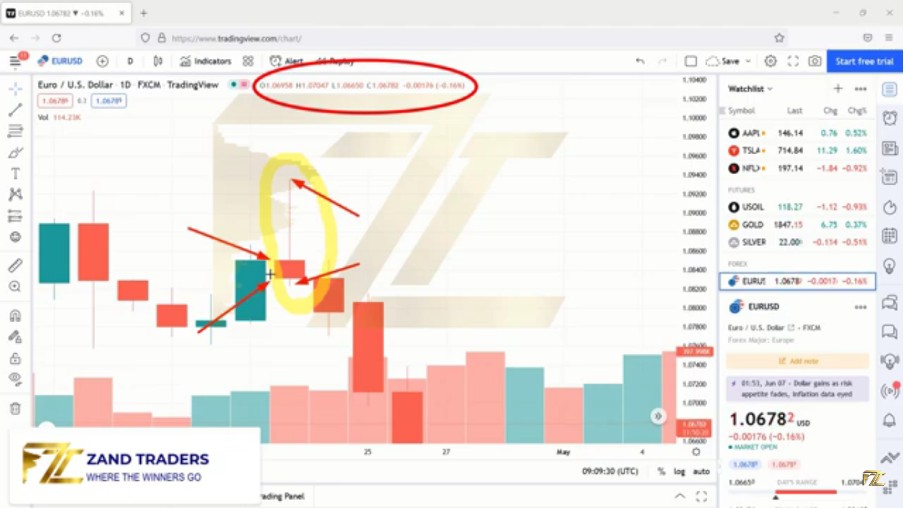

In the figure above, bar volumes are displayed at the bottom of the chart. This volume information displayed by Meta trader is taken from the broker’s server and cannot be trusted. Even if we monitor the volumes from reputable brokers such as FXCM, the results are still not reliable because the forex volumes are outside the stock market and this information is sold by brokers to banks and institutions so that they can use the stop loss of retail traders to make profit.

To access the correct data and concentrated volumes, we must use the level 2 of data of the futures market and view the correct data in that market. Now, after observing the data in the futures market and recognizing the flow of orders and analyzing the market, in the next step we come to the forex market and use Meta Trader only to take a trading position.

To use the futures market, we need a platform and data:

A platform that has the ability to connect to the futures market, Order flow facilities and tools, and the data provided by data providers, the volume data of the futures market is connected to platforms specific to the futures market. In fact, it can be said that the platform and data complement each other like a car that does not run without fuel.

At the same time, it is necessary to know what information does level one of data provide to us? In response, we can say, with this data, we will know about four prices.The opening price of the candle, the closing price of the candle, the highest price in the candle formation interval and the lowest price in the candle formation interval.

As you can see in the picture, in this chart, we can only analyze the market based on the shape of the candle, and the level 1 of data does not give us information about why the candle is formed, and we are practically unaware of the candle behind the curtain. It is not clear to us how many traders with what volume caused the candle to close in this way and we only see the appearance of the market.

In the next picture, you can see the chart that contains level 2 of data. As it is known, in addition to the four prices that we had in the level one data, other important information is also available to us, this information includes the number of buyers and sellers, the volume of buy and sell orders, the difference in the volume of buyers and sellers, etc. that may effective our decisions.

Level 2 of data has different levels and is divided into professional and non-professional data.

Level 3 of data is at a higher level and is known as data banks, which we will explain.

Now we have reached the end of the article on the differences between forex and futures market. In the following articles, we will explain more about level 2 of data and how to use this data.