Introduction of ninja trade facilities third part – Chart Trader

Introduction of ninja trade facilities third part – Chart Trader

Chart Trader feature review

If you have downloaded and installed the version of Ninja Trader from the Zand Traders telegram bot, you have the original version of Ninja Trader and you can use the Chart Trader panel.

In the demo version available on Ninjatrader.com, you can only use chart trader limit orders and you can place your limit or market orders by right clicking on the chart. Pay attention to the image below, when you click above the price, you will see the Sell limit option.

And if you right-click below the price, buy limit orders will be activated for you.

But the original version of Ninja Trader gives us more features, one of the most important features is ATM Strategy. Now let’s take a closer look at the Chart Trader panel.

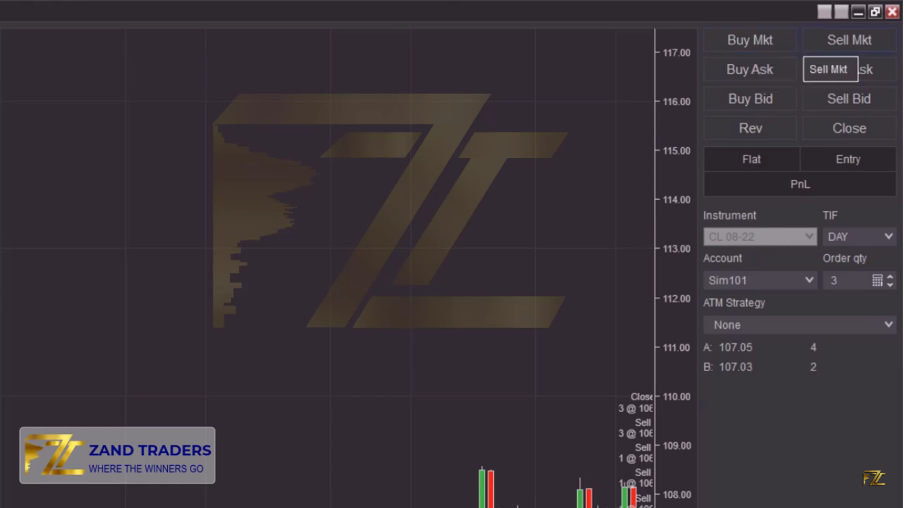

Pay attention to the first two options, Buy Mkt (Buy to market) and Sell Mkt (Sell to Market), these two options have the same functionality as the Buy and Sell keys in Meta trader and by clicking on them you are considered as an aggressive buyer or seller. In Ninja trader, it is not possible to hedge at the same time, hedging means opening a buying and selling position simultaneously on an instrument. This possibility is active on Meta trader. As a result, your trading type in Ninja Trader is Netting. This means that your buy or sell positions are automatically averaged by Ninja Trader, and when you have an active buy position, for example, by clicking on Sell, Ninja Trader closes part or all of your purchase.

You will see two numbers at the bottom of the panel, pay attention to the image:

This means that if you are a buyer, you should buy at the ask price, and if you are a seller, you should sell at the bid price.

The Buy Ask option is the same as Buy Mkt with a little difference.

The next option Buy Bid means buying at a better price.

What does this mean?! Pay attention to the image below.

The bid price is 106.97 and the trading price is 106.98, that is, the Bid price is one price tick lower, and by clicking the Buy Bid button, you enter a buy position at a better price. This order is a buy limit type. The important question is why we use Buy Bid instead of Buy Mkt?! As you know, Buy Mkt means entry if safe, and the purchase is made from the ask price, and if there is no sell limit order in the market at the time of your purchase, you will enter the market at much worse prices, that’s why we use buy Bid to Make the purchase at the best bid price.

Professional traders often trade with limits, and aggressive entry is for traders with high capital such as banks.

The next item is Sell Ask, which works exactly like Buy Bid. This means that our order at the best selling price is entered into the order book as a limit, and with this ordering method, we avoid slippage and selling at bad prices.

The next option is the Rev key, this option means Reverse. When you realize that you have mistakenly entered a buy transaction and intended to sell, by pressing this button, your transaction will be reversed, and it will also change the sale transaction to a buy transaction.

The next option is Close and it is to close the open positions at the same moment.

The next option is to show the amount and percentage of profit and loss of the open position. Pay attention to the image below.

The next option is instrument, in the Account section you have to choose your account, as it was said before, you choose the account you want to trade from among the three types of Simulator, Demo and Real accounts.

In the Order Quantity section, you determine the number of contracts for each position.

The next ATM Strategy option is an important part of the Chart Trader panel. Without setting up and building an ATM, you have to do all the work of placing orders, stops, and placing profit limits or TPs manually. Also, you should pay special attention to the fact that before your Buy Limit order is activated, for example, all stop orders and TP orders are considered independent orders and the possibility of activating your Sell limit order, which is set as a target for Buy Limit is exist. Therefore, in order to avoid such mistakes, you must set ATM strategy to each specific instrument.

If the price does not hit your buy limit order and the price moves up, the price can reach your profit limit which activates the sell limit.

It is even possible that the price of the buy order activates your limit and goes up and takes your profit limit and you close your trade with a profit, but your loss limit order, which is of Sell Stop or Sell Mkt type, is remain on the platform and inadvertently enter a sell position. All these events are due to the fact that all three orders are independent from each other. This is where you realize the importance of setting ATM Strategy. Because by using that your platform automatically sets the profit limit and the loss limit. There are various features in ATM, for example, raising the stop by increasing the price and several other features that we will discuss in the next article.