The method of volume trading from the past to the present

The method of volume trading from the past to the present

In this article, we are going to introduce the volume trading method and review the contents that you will learn in ZandTraders volume trading training course.

What is the The method of volume trading?

The volume trading method consists of various tools that discover and monitor important market volumes. This method looks for the areas where the big boys enter the market and move the market in their desired direction.

If you look at the price charts, you will notice the levels that when the price reaches them, it reacts and changes its path. We refer to these areas as support-resistance areas and we enter into trades in these areas.

Maybe you have been faced with the question of what is the reason for the price change and why does the price react in these areas?

The answer is very simple. Elders have been present in these areas and have made deals. So, every time the price returns to this area, they defend their positions and restore the price by reintroducing liquidity.

To check and monitor the movements of the elders, there are many tools in the volume trading method, which we intend to review briefly.

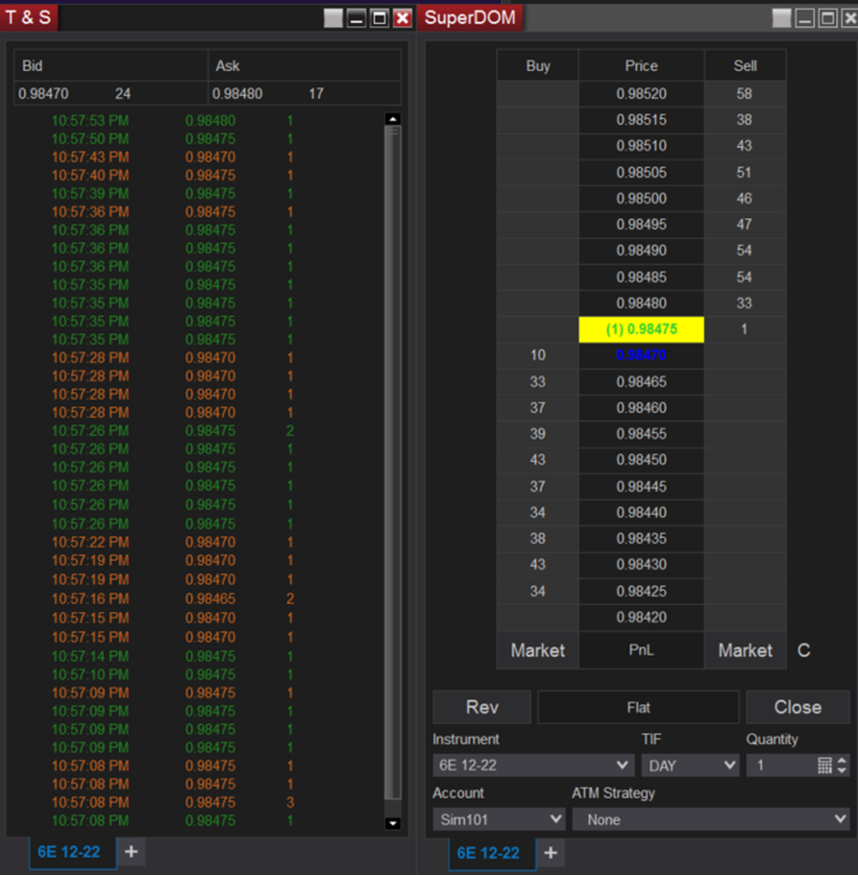

Order Book and Time and Sales List

The most important tools are ((Order Book)) and ((Time and Sales List)). In the importance of these tools, it should be said that these two are inseparable tools of volume trading. Order book is a tool that displays open buy and sell orders, while Time and Sales List shows completed orders. People who only trade with these two instruments are called ((Dom Traders)).

Market Profile

Another tool that used in the volume trading method is ((Market Profile)) or ((Volume Profile)). This tool displays market volumes horizontally for us. In Market Profile, we have tools such as Volume Profile (VP), Time Profile (TPO), Tick Profile (Tick) and ATS Profile (ATS), each of which has a separate definition and function. The most important part of this tool is the volume profile, which includes various components such as the edges of the Value Area, Poc, etc. and has its own trading strategies.

There are also traders who trade only with volume profile strategies, which are called ((VP Traders)).

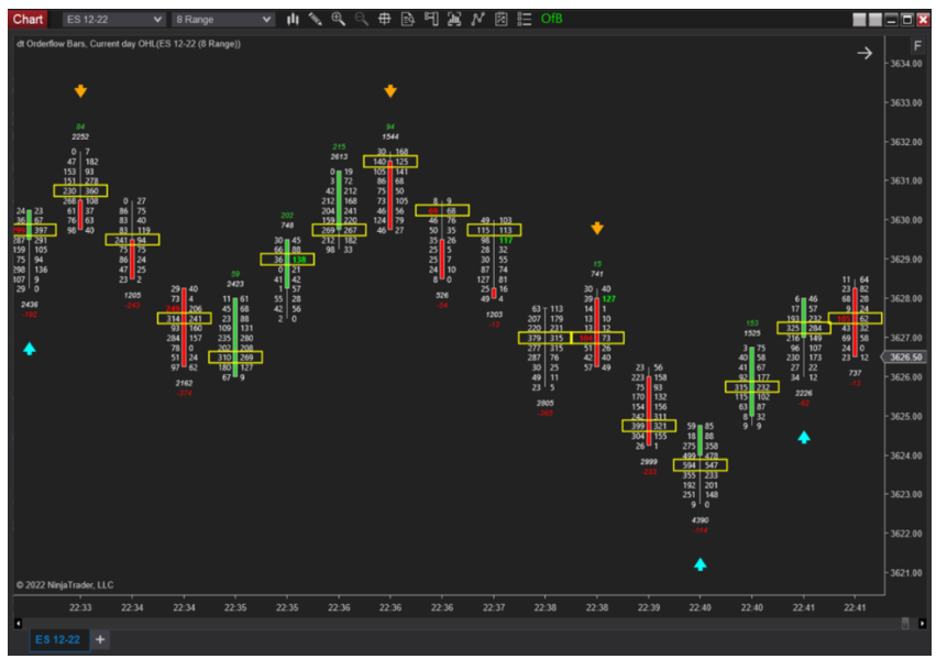

Footprint

Another part of the volume trading method is the footprint candles that you can see in the picture below. Here you see green or red candles with numbers written on them. These numbers are basically the buyers and sellers of the market, each on one side of the foot print. How to read these numbers and monitor market participants with footprints also has its own strategies that you will get to know completely in the volume trading course.

Another topic that is not discussed much nowadays is the topic of Volume Limit or Volume at Price.

It is better to know that there are generally three types of volumes. vertical volume, horizontal volume and Volume at Price. Vertical volume is actually volume per unit of time and horizontal volume per unit of price.

But the third type of volume and the one we deal with the most is volume at a point, which is called Volume Limit. Through volume limits, we see the volume at one point and check the movements of aggressive traders.

In the chart below, you can see the volume limits in the one-hour time frame. You can clearly see the price reaction to these volumes.

There is one thing you should know about volume limits. These volumes may have the right effect in some situations not everywhere. It is better to see the volume limits at certain points of the market to be more sure of their effect on the price.

As a final word, it should be said that there are some people who trade only with the help of these volumes. Note that these people are not called volume traders. Volume trading is a collection of all these tools that we introduced. These tools are placed next to each other according to a special strategy and make a single trading plan for you. Obviously, using some of these tools and relying on some of them has a lot of error and this work is not recommended due to high risk.